How BNY Mellon Became A Towering Pillar Of Global Finance

The megabank launched by the Mellon family is now the world’s largest securities services company.

Walk the streets of New York and you’ll pass by Carnegie Hall, One Vanderbilt, Rockefeller Center, and the Waldorf Astoria, structures ensuring the continued legacy of their Gilded-era heirs, headquartered at 240 Greenwich Street—may be slightly harder to find.

Yet while Carnegie, Rockefeller, and Vanderbilt are long gone; and in many aspects—so are their cultivated fortunes— the Mellon family, billionaire founders of the bank that bears their name, maintains both their legacy and their fortune, a tricky balancing act that most of America’s grandest families failed to master.

Unlike many of their peers, and perhaps to their great benefit, the Mellon family is happiest out of the spotlight. Instead, their family legacy is most visible in its shaping of the American economy, from the U.S. industrial revolution into modern times, in both the private and public sectors. The family has itself helped found multiple industries, built historically significant companies, and weathered financial crises along the way that ruined many of their peers.

Perhaps most important to Thomas Mellon, with his Scotch-Irish conservativism, would be the humility, caution and aversion to attention that he first passed along to his children, especially his most notable heir, Andrew Mellon, and is a continued pillar of the family’s ethos. It may seem odd that a family as notable, and noted, as the Mellon family has been throughout most of American history, has long eschewed public attention. But as one descendent told Forbes in a rare 2014 interview, “We’re happy being under the radar.”

Thomas Mellon arrived in America in 1818 when his family immigrated from Ireland, settling in Western Pennsylvania. Leaving the family farm for the rapidly expanding city of Pittsburgh, he became a successful lawyer and real-estate investor, climbing the social and economic ladders in the city. After a stint as a judge, Mellon returned not to law but to banking, opening T. Mellon & Sons Bank in 1869, serving customers in the Pittsburgh area.

Starting with only $10,000 in deposits, it would eventually become the largest banking institution in the United States outside of New York. Mellon was also well-placed, in time and location, to grow his bank on the back of the industrial revolution and the many industries then incorporating in the Pittsburgh area.

When the financial panic of 1873 caused many of the region’s banks to fail, T. Mellon & Sons narrowly survived, and after the dust had settled, Thomas had far fewer competitors. With industries like steel, petroleum and coal starting to build Pittsburgh into the industrial behemoth it would become, opportunities were abundant for those willing and able to finance these projects and companies that would become icons of American business.

Meanwhile there were fewer banks or lending institutions able to make these potentially lucrative investments, leaving a disproportionate share to those like Thomas Mellon, and his sons, Andrew and Richard, the namesakes who would join and lead the family business.

Between 1873 and 1882, control of the bank gradually passed to Andrew, although Thomas would continue to be involved in the bank’s activities over the intervening years. The family had used the previous decade to invest largely in the blossoming steel and related industries and now reaped the benefits, its fingers in many pies, across Western Pennsylvania and beyond.

A perfect example of serendipitous time and place in which the Mellon family found themselves can be seen in 1876 when Andrew was introduced by his father to a customer of their bank, Henry Clay Frick. With the help of Mellon-provided funds, Frick would buy out his partners in a coke manufacturing company and rename it H.C. Frick & Company, eventually controlling 80% of all coal mined by the commonwealth in the late 19th century.

Forming a partnership with Andrew Carnegie, Frick provided the coke needed for Carnegie’s steel empire, becoming one of the wealthiest of the era’s industrialists and financiers. The loans were also the start of a lifelong friendship, and partnership, between Andrew Mellon andFrick, that would see the two help finance the construction of postindustrial America, and make enormous fortunes in the process.

Andrew renamed the family’s institution, Mellon National Bank, the reorganized bank becoming a subsidiary of his Union Trust Company and joining the national banking system. At one point, the family would control just shy of 100 banks, focused on an array of industries. Each new business was enabled and supported by the main family business, Mellon National Bank, but they were also expected to carry their own weight. This continues into modern times as family members are expected to not only utilize the fortune but to add to it.

While others were getting rich in a single business or industry, the Mellon family was profiting off of doing business across many of these extremely profitable expanding industries. The list of companies founded either by the Mellon family or directly financed by the family’s financial empire is staggering and historic: Alcoa, Gulf Oil Corporation, Westinghouse Electric Company, Union Steel, and New York Shipbuilding Corporation, just to name a few. It’s not hyperbole to say that historically the Mellon family has their fingerprints not just on the American economy, but the global economy.

Their investments led to the formation of multinational corporations unlike the world had seen since perhaps the Dutch East India Company of the 17th century. When you also consider the Mellon family had helped finance the Allies during the first World War, via loans to combatants like France and by purchasing war bonds to support the American efforts in the conflict, the impact of the family and the family business become even more apparent on a global scale.

One key to the family fortune has been the ability of Thomas, and later Andrew, Richard and Paul, to see opportunities beyond normal banking transactions. Many of their loans took the form of investment stakes in prominent industries like aluminum, coal, and oil, expanding the Mellon’s empire beyond the financing of industry into industry itself. They even helped finance the creation of the world’s first billion-dollar company when U.S. Steel Corporation was formed by fellow financier J.P. Morgan and partners in 1901.

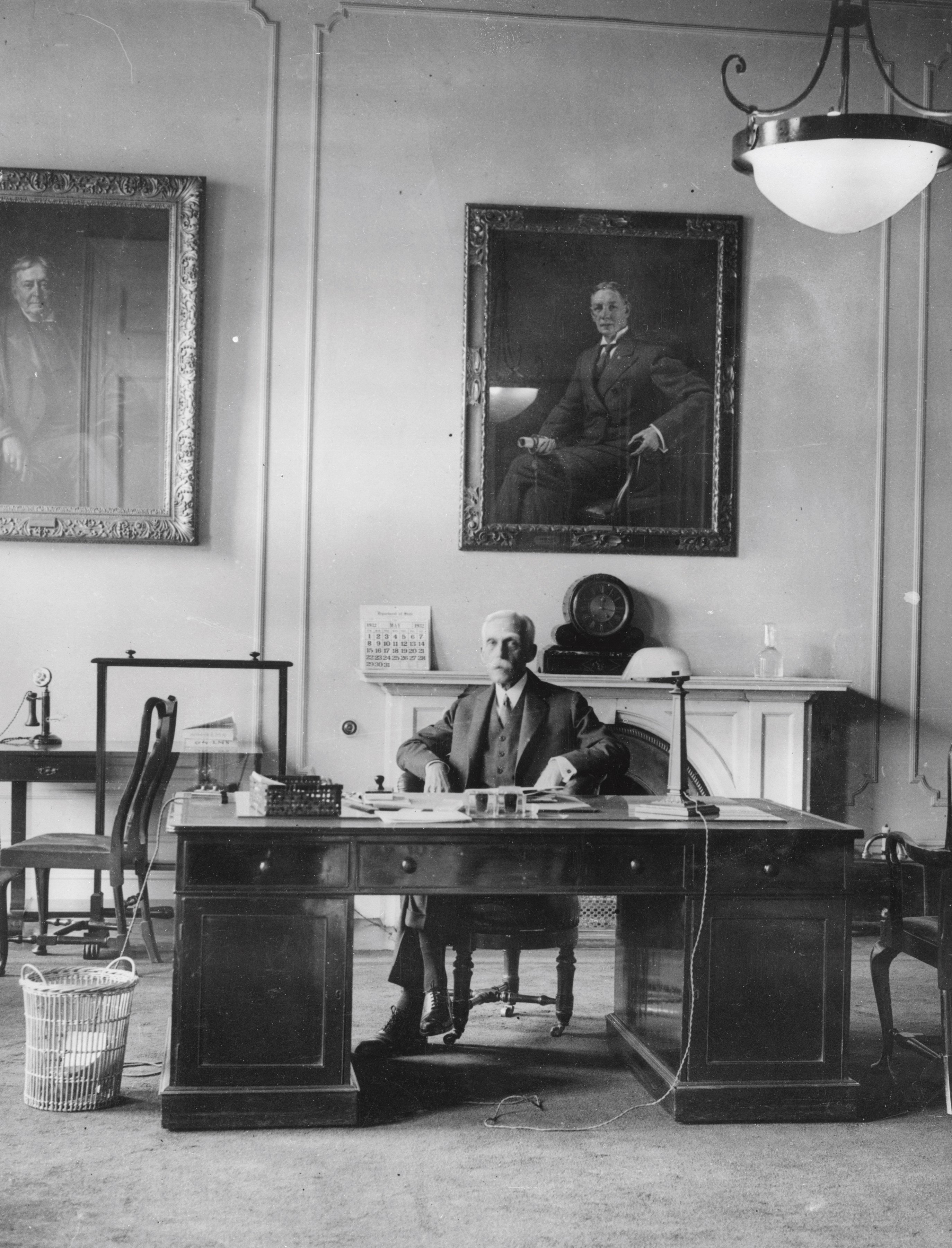

They held large stakes in many of the early 20th-century’s most valuable companies, even though few would ever use the Mellon family name. Despite a long-standing familial reluctance to enter the public spotlight, Andrew Mellon would go into the public sector in 1921 when he was nominated by President Warren G. Harding to be the Secretary of the Treasury. While the family had previously been involved somewhat in local and state politics, Andrew’s ascendance into this role would be perhaps one of the most impactful aspects of the Mellon family history.

He held the position for 11 years, from 1921 through 1932, becoming the third-longest running holder of the office and serving under three different presidents (Harding, Coolidge and Hoover). For much of the post-World War I era, Mellon would oversee vast economic growth and aboom in consumer spending and lifestyle that would become known as the Roaring Twenties.

His tax policies and other principles of the relationship between the public and private sectors has influenced future politicians like Ronald Reagan in their economic policies. This success, and the duration of his time as Secretary, made Mellon both powerful and influential. One politician, Senator George Norris, half-jokingly commented that “three presidents served under Secretary Mellon” in regards to Mellon’s influence over the government’s economic policies and taxation structures.

Andrew’s son, Paul Mellon, would act as the family’s public face after his father’s passing in 1937, and would usher the family and the family business into the modern age. Just as his grandfather and father before him, Paul would diversify the family’s business holdings.

Choosing not to center his career in the business world, Paul would focus on the arts and sport, becoming a leading collector of art and an accomplished racehorse breeder as well as one of the greatest American philanthropists of his time. His love of art was not surprising, as his father had been encouraged by Henry Clay Frick to invest in the art world, and it proved a wise investment both financially and culturally (a common theme in many of the Mellon family’s investments).

The Mellon family has numerous philanthropic foundations and causes, with the most significant being the Andrew W. Mellon Foundation, established in 1969 by Paul Mellon and his sister Ailsa Mellon Bruce and the largest humanities philanthropy in the United States. In 2022 the foundation was able to grant more than a half billion dollars in funds to causes such as higher education, social justice and of course the arts and humanities.

It’s in the charitable spirit of Andrew, who himself offered his world-renowned art collection, as well as a sizable endowment, to President Roosevelt in 1936 as a donation to the American people. If Andrew had the ego of his Gilded Age peers, we would all be visiting the Mellon Museum in Washington D.C. to view his collection of priceless artworks, instead of the National Gallery of Art.

The Mellon family’s business had long ago spread to dozens if not hundreds of individual companies, but the centerpiece was still the Mellon Financial Corporation. Then in 2007, the century-old company completed a merger with the Bank of New York in a deal worth $16.5 billion. Today, BNY Mellon, as the company is known, is the largest securities services company and custodian bank in the world.

As of 2023, with a staggering $2.0 trillion of assets under management and a $47.8 trillion in assets under custody and/or administration, BNY Mellon is a core pillar of the global financial markets beyond what even Thomas or Andrew Mellon could have possibly dreamed. The Mellon family, perhaps more than any other, helped build this country, with or without their name on a museum

This article originally appeared in the March/April 2024 issue of Maxim magazine.